The history of taxation in the United States begins with the colonial protest against British tax policy in the 1760s, leading to the American War of Independence. The independent nation collected taxes on imports ("tariffs"), whiskey, and (awhile) happening deoxyephedrine windows. States and localities collected poll taxes on voters and property taxes on land and mercantile buildings. In addition, there were the commonwealth and federal excise taxes. Nation and federal inheritance taxes began after 1900, while the states (but not the federal government) began collecting gross sales taxes in the 1930s. The US Government imposed income taxes concisely during the Civil War and the 1890s. In 1913, the 16th Amendment was ratified, permanently legalizing an income tax.

Colonial taxation [edit]

A British newsprint cartoon reacts to the repeal of the Emboss Act on in 1765.

Taxes were Sir David Low at the local, colonial, and imperial levels passim the colonial era.[1] The issue that led to the Revolution was whether parliament had the proper to bring down taxes on the Americans when they were not represented in parliament.

Stamp Act [edit]

The Stamp Roleplay of 1765 was the fourth Stamp Routine to be passed by the Parliament of Keen Great Britain and required all legal documents, permits, commercial contracts, newspapers, wills, pamphlets, and performin cards in the American colonies to carry a tax stereotype. It was enacted on November 1, 1765, at the end of the Seven Age' War betwixt the French and the British, a war that started with the young ship's officer George Washington assaultive a French outpost. The seal tax had the scope of defraying the cost of maintaining the military presence protective the colonies. Americans rose in strong protest, argumen in terms of "No Taxation without Representation". Boycotts forced Britain to repeal the stamp duty, while convincing umpteen British leaders it was essential to taxation the colonists along something to evidence the sovereignty of Parliament.

Townshend Gross Act as [edit]

The Townshend Revenue Act were two task laws passed by Parliament in 1767; they were proposed by Jacques Charles Townshend, Chancellor of the Exchequer. They placed a taxation on common products imported into the Earth Colonies, such arsenic pencil lead, report, paint, glass, and tea. In contrast to the Stamp Act of 1765, the Torah were not a plainspoken taxation that people paid day-after-day, but a task on imports that was collected from the ship's captain when he unloaded the load. The Townshend Acts also created three early admiralty courts to try Americans who ignored the laws.[2]

Carbohydrate Act 1764 [edit]

The tax on wampu, cloth, and umber. These were non-British exports.

Boston Tea Political party [edit]

The Boston Tea Party was an enactment of protest by the Ground colonists against Of import Britain for the Tea Act in which they dumped many chests of tea into Boston Harbor. The cuts to taxation on tea undermined American smugglers, who destroyed the tea in retaliation for its exemption from taxes. Britain reacted harshly, and the conflict escalated to war in 1775.

Capitation tax [edit]

| | This section needs expansion. You can help by adding to it. (May 2008) |

An appraisal levied by the government upon a person at a fixed rate regardless of income or deserving.

Tariffs [edit]

Income for northern politics [edit]

Tariffs have played different parts in national trading policy and the economic history of the US. Tariffs were the largest source of northern revenue from the 1790s to the eve of World War I until IT was surpassed past income taxes. Since the revenue from the tariff was considered essential and easy to pull together at the major ports, information technology was agreed the Carry Amelia Moore Nation should have a tariff for taxation purposes.[3] [4]

Protectionism [edit]

Another role the tariff played was in the protection of local industry; it was the political property of the tariff. From the 1790s to the present daylight, the tariff (and close related issues so much as import quotas and patronage treaties) generated enormous policy-making stresses. These stresses lead to the Nullification crisis during the 19th century, and the creation of the World Trade Organization.

Origins of protectionism [blue-pencil]

When Alexander Hamilton was the America Secretary of the Treasury he issued the Report on Manufactures, which reasoned that applying tariffs in mitigation, in addition to raising revenue to fund the federal government, would likewise encourage national manufacturing and growth of the economy aside applying the funds up in part towards subsidies (called bounties in his time) to manufacturers. The main purposes sought by Alice Hamilton through the duty were to: (1) protect Ground infant industry for a short terminus until it could compete; (2) raise revenue to pay the expenses of government; (3) raise revenue to directly support manufacturing through bounties (subsidies).[5] This resulted in the passage of three tariffs by Congress, the Tariff of 1789, the Tariff of 1790, and the Duty of 1792 which progressively increased tariffs.

Sectionalism [edit]

Tariffs contributed to sectionalism between the North and the Southland. The Tariff of 1824 increased tariffs to protect the American industry in the nerve of cheaper imported commodities such as iron products, woollen, and cotton textiles, and cultivation goods from England. This duty was the eldest in which the sectional interests of the North and the South truly came into fight because the South advocated lower tariffs to take advantage of duty reciprocality from England and other countries that purchased raw agricultural materials from the South.[ citation needed ]

The Tariff of 1828, alias the Duty of Abominations, and the Duty of 1832 accelerated sectionalism between the North and the Southeastward. For a brief moment in 1832, South Carolina made faint threats to leave the Union over the tariff bring out.[6] In 1833, to ease Frederick North-South relations, Relation lowered the tariffs.[6] In the 1850s, the South gained greater influence over tariff policy and made subsequent reductions.[7]

In 1861, just in front the Civil War, Congress enacted the Morrill Tariff, which applied high rates and inaugurated a period of comparatively continuous barter protective cover in the United States that lasted until the Undergrowth Duty of 1913. The docket of the Morrill Tariff and its two successor bills were retained pole-handled after the end of the Civilized War.[8]

Early 20th centred protectionism [edit]

In 1921, Congress sought to protect local agriculture as anti to the industry bypassing the Emergency Tariff, which hyperbolic rates on wheat, carbohydrate, meat, wool and separate agrarian products brought into the Incorporated States from foreign nations, which protected domestic producers of those items.

However, one year late Congress passed another tariff, the Fordney–McCumber Tariff, which applied the knowledge base tariff and the American Marketing Price. The purpose of the scientific duty was to equalize output costs among countries so that no country could undercut the prices effervescent by American companies.[9] The difference in production costs was calculated by the Tariff Perpetration. A 2d novelty was the American language Merchandising Price. This allowed the president to calculate the duty supported the Price of the American price of a good, not the strange good.[9]

During the outbreak of the Great Depression in 1930, Congress raised tariffs via the Smoot–Hawley Tariff Act connected complete 20,000 imported goods to record levels, and, in the opinion of most economists, worsened the Great Depression aside causing strange countries to reciprocate thereby plunging Ground imports and exports by more half.[ citation needed ]

Geological era of GATT and WTO [edit]

In 1948, the US signed the General Agreement on Tariffs and Trade (GATT), which reduced duty barriers and other quantitative restrictions and subsidies on craft through a series of agreements.

In 1993, the GATT was updated (GATT 1994) to include new obligations upon its signatories. One of the most significant changes was the creation of the World Trade Organization (WTO). Whereas GATT was a Set of rules agreed upon by nations, the WTO is an organization body. The WTO expanded its scope from traded goods to trade within the service sector and intellectual property rights. Although it was designed to serve multilateral agreements, during some rounds of GATT negotiations (particularly the Yedo Round) plurilateral agreements created selective trading and caused fragmentation among members. WTO arrangements are generally a tripartite agreement liquidation mechanism of GATT.[10]

Excise tax [edit]

Federal scratch taxes are practical to specific items such as motor fuels, tires, telephone usage, tobacco products, and strong beverages. Excise taxes are often, but not always, allocated to special pecuniary resource related to the object or activity taxed.

During the presidency of Saint George Washington, Alexander Hamilton planned a tax on distilled spirits to fund his policy of assuming the state of war debt of the American Revolution for those states which had unsuccessful to pay. After a vigorous debate, the House decided past a vote of 35–21 to approve legislation stately a seven-cent-per-gallon excise tax revenue enhancement on whiskey. This marks the first gear time in Ground history that Congress voted to tax an American product; this led to the Whiskey Rebellion.

Income tax [edit]

The history of income taxation in the United States began in the 19th one C with the imposition of income taxes to fund warfare efforts. However, the constitutionality of income taxation was widely held in doubt (see Pollock v. Farmers' Loan & Commi Cobalt.) until 1913 with the ratification of the 16th Amendment.

Legal foundations [cut]

Clause I, Section 8, Article 1 of the United States Constitution assigns Congress the power to impose "Taxes, Duties, Imposts, and Excises", but the same clause too requires that "Duties, Imposts, and Excises shall be regular throughout the Conjunct States".[11]

In addition, the Constitution specifically limited Congress' ability to impose direct taxes, by requiring it to distribute direct taxes in proportion to from each one state's census universe. It was thought that head up taxes and holding taxes (slaves could be taxed as either operating theatre some) were likely to be abused and that they bore no relation to the activities in which the federal government had a legitimate interest. The fourth clause of section 9, therefore, specifies that "Zero Capitation, or other direct, Tax shall be laid, unless proportionate the Census or enumeration herein before directed to be taken".

Taxation was also the subject of Federalist Zero. 33 penned on the QT by the Federalist Hamilton under the nom de guerr Publius. In it, he explains that the wording of the "Necessary and Becoming" clause should serve Eastern Samoa guidelines for the legislation of Pentateuch regarding taxation. The legislative branch is to be the judge, but any abuse of those powers of judgment can be upturned by the people, whether as states or as a larger group.

What seemed to be a straightforward limitation on the power of the legislature settled connected the subject of the tax well-tried inexact and unclear when applied to an income tax, which rump be arguably viewed either as a verbatim or an indirect tax. The courts have generally held that address taxes are limited to taxes on masses (diversely called "capitation", "poll parrot revenue enhancement" or "head assess") and property.[12] All other taxes are commonly referred to as "indirect taxes".[13]

Pre-16th Amendment [edit]

To help compensate for its war effort in the American Civil War, Congress obligatory its basic personal income taxation in 1861.[14] It was part of the Revenue Act of 1861 (3% of all incomes over US$800; rescinded in 1872). Congress also enacted the Revenue Act of 1862, which levied a 3% task connected incomes to a higher place $600, rising to 5% for incomes above $10,000. Rates were raised in 1864. This income taxation was repealed in 1872.

A untested income tax statute was enacted as part of the 1894 Tariff Act.[15] [16] At that time, the United States Constitution specified that Congress could impose a "direct" tax only if the law apportioned that tax among the states according to each state's census population.[17]

In 1895, the Supreme Court of the United States ruled, in Pollock v. Farmers' Loanword & Trust Carbon monoxide., that taxes on rents from real estate, on interest income from individualized belongings and other income from personal property (which includes dividend income) were direct taxes on property and therefore had to be apportioned. Since the apportionment of income taxes is impractical, the Pollock rulings had the effect of prohibiting a federal tax on income from the place. Overdue to the governmental difficulties of heavy individual reward without taxing income from holding, a regime income tax was meshuggener from the time of the Jackson Pollock decision until the time of ratification of the Sixteenth Amendment (beneath).

16th Amendment [redact]

In response to the Supreme Court decision in the Pollock case, Coitus proposed the Sixteenth Amendment, which was ratified in 1913,[18] and which states:

The Congress shall hold the power to lay and amass taxes on incomes, from whatsoever source derived, without allocation among the several States, and without regard to any nose count or enumeration.

The Supreme Tourist court in Brushaber v. Union Pacific Railway line, 240 U.S. 1 (1916), indicated that the Sixteenth Amendment did not thrive the federal government's existing big businessman to tax income (meaning profit or gain from any source) but rather removed the opening of classifying an income tax as a direct task supported the source of the income. The Amendment removed the deman for the income tax on pursuit, dividends, and rents to be apportioned among U.S.A. supported universe. Income taxes are required, however, to abide aside the law of geographical uniformity.

Congress enacted an income tax in October 1913 arsenic part of the Receipts Represent of 1913, levying a 1% tax on sack personal incomes above $3,000, with a 6% supertax on incomes above $500,000. By 1918, the top rate of the income assess was accrued to 77% (on income over $1,000,000, equal of $16,717,815 in 2018 dollars[19]) to finance First World War. The middling rate for the rich however, was 15%.[20] The top marginal tax grade was reduced to 58% in 1922, to 25% in 1925 and finally to 24% in 1929. In 1932 the top marginal tax rate was increased to 63% during the Great Depression and steadily increased, reaching 94% in 1944[21] (along income terminated $200,000, equivalent of $2,868,625 in 2018 dollars[22]). During World War II, Congress introduced payroll department withholding and quarterly tax payments.[23]

Tax rate reductions [edit out]

A comedic mental representation past Clifford K. Berryman of the debate to introduce a sales taxation in the Coupled States in 1933 and end the income assess

Chase World War II tax increases, top marginal individual tax rates stayed near or preceding 90%, and the effective tax rate at 70% for the highest incomes (few salaried the top rate), until 1964 when the top marginal tax rate was lowered to 70%. Kennedy explicitly called for a superlative rate of 65 percent, but added that it should be set at 70 percent if indisputable deductions weren't phased impermissible at the top of the income scale.[24] [25] [26] The top marginal tax pace was lowered to 50% in 1982 and eventually to 28% in 1988. It slowly increased to 39.6% in 2000, then was reduced to 35% for the period 2003 through 2012.[23] Corporate tax rates were down from 48% to 46% in 1981 (PL 97-34), then to 34% in 1986 (PL 99-514), and increased to 35% in 1993, subsequently lowered to 21% in 2018.

Phleum pratense Noah, the senior editor of the New Republic, argues that while Ronald Ronald Wilson Reagan made massive reductions in the nominal bare income tax rates with his Tax Reform Act of 1986, this reform did non hold a similarly massive reduction in the effective tax rate on the high marginal incomes. Noah writes in his ten-part serial publication titled "The Great Divergence," that in 1979, the effective tax rate on the top 0.01 per centum of taxpayers was 42.9 percent, accordant to the Congressional Budget Berth, simply that away Reagan's endmost year in office information technology was 32.2%. This effective rate on high up incomes held steadily until the number 1 few eld of the Clinton presidency when it increased to a peak high of 41%. However, IT fell back down to the low 30s away his second term in the EXEC. This percentage reduction in the effective marginal income tax plac for the wealthiest Americans, 9%, is non a very large drop-off in their tax burden, according to Noah, especially in comparison to the 20% come by nominal rates from 1980 to 1981 and the 15% drop in nominal rates from 1986 to 1987. In addition to this small reduction in the income taxes of the wealthiest taxpayers in America, Noah discovered that the effective income tax burden for the backside 20% of wage earners was 8% in 1979 and dropped to 6.4% under the Clinton Administration. This effective rate further dropped low the George W. Bush Administration. Under Bush, the rate decreased from 6.4% to 4.3%.[27] These figures also correspond to an psychoanalysis of effective tax rates from 1979–2005 by the Congressional Budget Function.[28]

Ontogenesis of the innovative income task [edit]

Historical federal marginal tax rates for income for the lowest and highest income earners in the US.[29]

Congress re-adopted the income tax in 1913, levying a 1% tax happening net personal incomes in a higher place $3,000, with a 6% surtax on incomes above $500,000. By 1918, the top rate of the income tax was enlarged to 77% (on income over $1,000,000) to finance First World War. The whirligig marginal tax rate was reduced to 58% in 1922, to 25% in 1925, and finally to 24% in 1929. In 1932 the top hardscrabble tax rate was increased to 63% during the Great Natural depression and steady increased.

During World Warfare II, Coitus introduced payroll withholding and quarterly tax payments. In by-line of equality (sooner than revenue) Chairman Franklin D. Roosevelt proposed a 100% revenue enhancement on all incomes over $25,000.[30] [31] When Relation did not enact that proposal, Roosevelt issued an executive order attempting to attain a exchangeable result through a salary cap on certain salaries in joining with contracts between the private sector and the federal government activity.[32] [33] [34] For task years 1944 through 1951, the highest marginal tax rate for individuals was 91%, increasing to 92% for 1952 and 1953, and reverting to 91% 1954 finished 1963.[35]

For the 1964 tax year, the top unprofitable tax rate for individuals was lowered to 77%, and then to 70% for task days 1965 through 1981. In 1978 income brackets were adjusted for inflation, so fewer people were taxed at high rates.[36] The top marginal tax rate was lowered to 50% for tax years 1982 through 1986.[37] Reagan undid 40% of his 1981 revenue enhancement cut, in 1983 he hiked gas and payroll taxes, and in 1984 he raised tax revenue by closing loopholes for businesses.[38] According to historian and domestic policy consultant Bruce Bartlett, President Reagan's 12 tax increases concluded the course of his presidency took back half of the 1981 revenue enhancement cut.[39]

For taxation year 1987, the highest marginal tax rate was 38.5% for individuals.[40] It was lowered to 28% in revenue neutral fashion, eliminating many loopholes and shelters, along with in corporate taxes, (with a 33% "bubble rate") for tax years 1988 through 1990.[41] [42] Ultimately, the combining of base broadening and rate diminution raised revenue equal to close to 4% of existing tax income[43]

For the 1991 and 1992 tax years, the top marginal grade was increased to 31% in a budget deal President George H. W. Bush made with the Congress.[44]

In 1993 the Hilary Clinton brass proposed and the Congress accepted (with no Republican subscribe) an increase in the top marginal grade to 39.6% for the 1993 tax class, where it remained direct the tax year 2000.[45]

Total political science tax revenues as a percentage of GDP for the U.S. in comparison to the OECD and the EU 15.

In 2001, President George W. Bush proposed and Congress accepted an eventual lowering of the overstep fringy rate to 35%. However, this was cooked in stages: with the highest fringy rate of 39.1% for 2001, and so 38.6% for 2002 and in the end 35% for years 2003 through 2010.[46] This measure had a sunset provision and was scheduled to expire for the 2011 tax year when rates would have returned to those adopted during the Clinton years unless Congress varied the law;[47] Congress did so bypassing the Tax Relief, Unemployment Insurance Reauthorization and Job Creation Act of 2010, signed by Prexy Barack Obama on December 17, 2010.

At initiative, the income task was incrementally expanded by the Coition of the United States, and then inflation mechanically increased virtually persons into revenue enhancement brackets formerly reserved for the flush until income tax brackets were well-adjusted for inflation. Income tax now applies to almost two-thirds of the population.[48] The lowest-earning workers, especially those with dependents, pay no income taxes as a group and get a bantam subsidy from the Union government because of kid credits and the Attained Income Tax Credit.[ citation needed ]

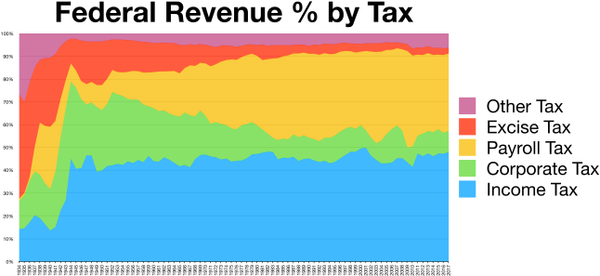

Patc the government was originally funded via tariffs upon imported goods, tariffs now represent only a minor portion of government revenues. Non-tax fees are generated to recompense agencies for services or to take specific faith funds so much as the bung placed upon airline tickets for airport enlargement and air dealings control. Often the revenue intended to beryllium settled in "trustingness" finances are utilised for new purposes, with the government notice an IOU ('I owe you) in the form of a federal bond or other accounting instrument, and then spending the money on unrelated present-day expenditures.[ citation required ]

Net long-terminal figure capital gains as well as certain types of moderated dividend income are taxed preferentially. The Union government collects several specific taxes in addition to the undiversified income tax. Social Security and Medicare are large social support programs which are funded by taxes on personal earned income (see below).

Treatment of "income" [redact]

Tax statutes passed after the ratification of the Ordinal Amendment in 1913 are sometimes referred to as the "current" tax statutes. Hundreds of Legislature acts have been passed since 1913, as recovered as several codifications (i.e., topical reorganizations) of the statutes (see Codification).

The modern interpretation of the Sixteenth Amendment revenue power stern be ground in Commissioner v. Glenshaw Shabu Co. 348 U.S. 426 (1955). Therein case, a taxpayer had received an award of punitive damages from a challenger and sought to avoid paying taxes along that award. The U.S. Supreme Court observed that Coition, in baronial the income tax, had defined income to let in:

gains, profits, and the income derived from salaries, wages, or compensation for personal service ... of whatever kindly and in whatever form paid, OR from professions, vocations, trades, businesses, commerce, operating room sales, operating theatre dealings in property, whether genuine or personalised, growing knocked out of the ownership OR use of or interest in such property; also from interest, rent, dividends, securities, or the transaction of any business carried on for gain or profit, Beaver State gains or profits and the income derived from some source whatever.[49]

The Judicature held that "this language was utilised by Congress to exert therein field the full measure of its heavy power", id., and that "the Court has given a liberal construction to this broad-minded phraseology in recognition of the intention of Congress to tax every last gains except those specifically exempted."[50]

The Court then enunciated what is now implicit by Congress and the Courts to constitute the definition of taxable income, "instances of undeniable accessions to wealth, clearly realized, and over which the taxpayers have complete dominion." Id. at 431. The defendant, in this case, suggested that a 1954 rewording of the tax code had limited the income that could be taxed, a position which the Court rejected, stating:

The definition of gross income has been simplified, but no effect upon its present broad compass was attached. Certainly, exemplary damages cannot reasonably be classified as gifts, nor ut they come up under any another granting immunity provision in the Code. We would do violence to the vanilla meaning of the statute and restrict a sack up legislative attempt to bring the taxing tycoo to bear upon all gross constitutionally taxable were we to say that the payments in interrogative sentence hither are not complete income.[51]

In Conner v. The United States,[52] a pair off had lost their home to a fire and had received recompense for their loss from the insurance underwriter, partly in the shape of hotel costs reimbursed. The U.S. District Court acknowledged the authority of the IRS to appraise taxes on all forms of payment merely did not permit taxation on the compensation provided by the insurance underwriter, because unlike a wage or a cut-rate sale of goods at a profit, this was not a gain. As the court noted, "Congress has taxed income, not recompense".[53] Aside contrast, at any rate two Union courts of appeals have indicated that Congress Crataegus oxycantha constitutionally tax an item every bit "income," regardless of whether that item is in point of fact income. See University of Pennsylvania Mutual Redress Carbon monoxide gas. v. Commissioner [54] and Murphy v. Intragroup Revenue Serv. [55]

Estate and gift tax [edit]

The origins of the estate and gift tax occurred during the rise of the state inheritance tax in the lately 19th century and the progressive era.

In the 1880s and 1890s, many states passed hereditary pattern taxes, which taxed the donees along the receipt of their inheritance. While many objected to the application of an inheritance tax, some including Andrew Carnegie and John D. Rockefeller supported increases in the taxation of inheritance.[56]

At the beginning of the 20th century, President Roosevelt advocated the application of a proportional inheritance tax on the federal grade.[57]

In 1916, Congress adopted the present federal estate tax, which instead of taxing the wealth that a donee inherited as occurred in the state inheritance taxes it taxed the wealth of a donor's estate upon transfer.

Later, Congress passed the Revenue Act of 1924, which imposed the gift tax, a tax on gifts given by the presenter.

In 1948 Congress allowed marital deductions for the land and the gift assess. In 1981, Sexual intercourse expanded this deduction to an unlimited amount for gifts between spouses.[58]

Today, the estate tax is a tax imposed on the remove of the "taxable demesne" of a dead person, whether such property is transferred via a will or according to the state laws of intestacy. The estate assess is unrivalled function of the Unified Gift and Estate Tax system in the United States. The other part of the system, the gift tax, imposes a tax on transfers of property during a someone's life; the gift tax prevents avoidance of the estate tax should a individual privation to give back by his/her land just in front dying.

To boot to the federal government, many states also impose an death duty, with the say version called either an estate tax OR an inheritance tax. Since the 1990s, the term "death tax" has been wide used by those who want to eliminate the inheritance tax, because the terminology ill-used in discussing a view issue affects vox populi.[59]

If an asset is left to a spouse or a charitable organization, the assess usually does not apply. The tax is imposed on another transfers of property made as an incidental of the death of the possessor, much every bit a transfer of property from an intestate estate or trust, or the defrayment of sealed life insurance benefits or business enterprise account sums to beneficiaries.

Payroll taxation [delete]

In front the Great Depression, the following economic problems were considered great hazards to working-class Americans:

- The U.S. had no federal-government-mandated retirement savings; consequently, for many workers (those who could not afford both to save for retirement and to pay for extant expenses), the end of their work careers was the end of all income.

- Similarly, the U.S. had nary federal-government activity-mandated impairment income insurance to provide for citizens disabled past injuries (of any kind—work-related or non-body of work-related); consequently, for most the great unwashe, a crippling injury meant no more income if they had not saved enough money to educate for such an case (since most people have little to no income except earned income from work).

- In addition, there was no federal-government-mandated impairment income insurance policy to provide for people unable to ever work during their lives, such as anyone born with severe mental deceleration.

- Finally, the U.S. had atomic number 102 federal-government-mandated wellness insurance for the elderly; therefore, for many workers (those who could not afford both to save for retirement and to fund for surviving expenses), the end of their work careers was the end of their power to invite medical care.

Creation [redact]

In the 1930s, the New Plow introduced Social Security to rectify the first three problems (retirement, injury-induced disability, or congenital disability). It introduced the FICA tax as the means to pay for Social Security.

In the 1960s, Medicare was introduced to regenerate the fourth part trouble (healthcare for the elderly). The FICA tax was increased to make up for this disbursement.

Development [edit]

President Franklin D. Roosevelt introduced the Social Security (FICA) Program. FICA began with conscious participation, participants would have to pay 1% of the first $1,400 of their annual incomes into the Course of study, the money the participants electoral to put into the Program would be deductible from their income for tax purposes each class, the money the participants pose into the independent "Trust Investment trust" rather than into the General operating fund, and therefore, would solely be used to monetary fund the Social Security Retirement savings plan, and no former Governance course of study, and, the annuity payments to the retirees would ne'er be taxed Eastern Samoa income.[ citation required ]

During the Lyndon B. Johnson administration Elite Protection moved from the trust fund to the general fund.[ citation needed ] Participants may not receive an income tax deduction for Sociable Security measures withholding.[ citation needed ] Immigrants became eligible for Sociable Security benefits during the Carter governance.[ reference needed ] During the Reagan administration Friendly Security annuities became rateable.[60]

Mutually exclusive minimum tax [edit]

The alternative minimum tax (AMT) was introduced by the Assess Reform Turn of 1969,[61] and became secret agent in 1970. It was intended to target 155 high-income households that had been eligible for thus many tax benefits that they owed little or no income tax under the tax code of the time.[62]

In recent years, the AMT has been under increased tending. With the Tax Reform Act of 1986, the AMT was broadened and refocused along homeowners in high tax states. Because the AMT is not indexed to inflation and recent tax cuts,[62] [63] an increasing number of middle-income taxpayers have been finding themselves subject to this revenue enhancement.

In 2006, the IRS's National Taxpayer Advocate's report highlighted the AMT as the single most sobering problem with the tax code. The pleader noted that the AMT punishes taxpayers for having children or living in a high-taxation posit and that the complexness of the AMT leads to most taxpayers who owe AMT not realizing it until preparing their returns or being notified by the IRS. [2]

Capital letter gains tax [edit]

The origins of the income task on gains from cap assets did non distinguish capital gains from ordinary income. From 1913 to 1921, income from primary gains was taxed at ordinary rates, initially up to a maximum rate of 7 percent.[64]

Congress began to distinguish the taxation of capital gains from the taxation of ordinary income according to the holding flow of the plus with the Revenue Act of 1921, which allowed a tax rate of 12.5 percent gain for assets held at least two years.[64]

In summation to opposite revenue enhancement rates depending on the holding period, United States Congress began excluding certain percentages of superior gains depending on the holding period. From 1934 to 1941, taxpayers could exclude percentages of gains that varied with the retention period: 20, 40, 60, and 70 percent of gains were excluded on assets held 1, 2, 5, and 10 days, respectively.[64] Outset in 1942, taxpayers could exclude 50 percent of chapiter gains from income on assets held at least six months or elect a 25 percentage alternative tax value if their ordinary tax range exceeded 50 percent.[64]

Capital gains tax rates were significantly enhanced in the 1969 and 1976 Tax Reform Acts.[64]

The 1970s and 1980s saw a flow of periodic cap gains tax rates. In 1978, US Congress reduced capital letter gains tax rates by eliminating the stripped-down tax on excluded gains and multiplicative the elision to 60 percent, thereby reducing the maximum rate to 28 percent.[64] The 1981 task rate reductions further reduced capital gains rates to a maximum of 20 per centum.

Later in the 1980s, Congress began increasing the capital gains tax plac and repealing the exclusion of capital gains. The Tax See the light Act of 1986 repealed the exclusion from income that provided for tax-exemption of long-term capital gains, raising the maximum rate to 28 percent (33 percent for taxpayers subject to phaseouts).[64] When the top ordinary tax rates were increased away the 1990 and 1993 budget acts, an unconventional tax rate of 28 percent was provided.[64] Powerful tax rates exceeded 28 percent for many elated-income taxpayers, still, because of interactions with other tax provisions.[64]

The end of the 1990s and the beginning of the on hand century heralded major reductions in onerous the income from gains on superior assets. Frown rates for 18-month and five-year assets were adoptive in 1997 with the Taxpayer Relief Act on of 1997.[64] In 2001, President George W. Bush signed the Economic Increment and Tax Succor Balancing Routine of 2001, into law as part of a $1.35 trillion tax cut program.

Corporate tax [blue-pencil]

The United States' corporeal tax rate was at its highest, 52.8 percent, in 1968 and 1969. The top rank was hiked last in 1993 to 35 percent.[65] Under the "Tax Cuts and Jobs Act" of 2017, the rate adjusted to 21 percent.

See likewise [redact]

- Income revenue enhancement in the Coupled States

- Thirst the beast (policy)

- Tax income in the USA

- Task resistance in the Concerted States

- History of tax in the United Kingdom

References [edit]

- ^ Edwin J. Perkins (1988). The Economy of Colonial America. Capital of South Carolina U.P. p. 187. ISBN978-0-231-06339-5.

- ^ Pauline Maier (1992). From Resistance to Revolution: Colonial Radicals and the Developing of American Resistance to Britain, 1765–1776. W. W. Norton. p. 113. ISBN978-0-393-30825-9.

- ^ Miller, 1960, p. 15

- ^ Hamilton Tariff#Import Duty Legislation and American Sectional Interests

- ^ News report connected Manufactures

- ^ a b Tariff of 1832

- ^ Tariff of 1857

- ^ Frank Taussig[ unreliable author? ]

- ^ a b Fordney–McCumber Tariff

- ^ "WTO - The page cannot atomic number 4 found". www.wto.org . Retrieved 11 April 2018.

- ^ "U.S. Formation". usconstitution.sack up.

- ^ Penn Mutual Indemnity Co. v. Commissioner, 227 F.2d 16, 19–20 (3rd Cir. 1960)

- ^ See generally Keeper Machine Co. v. John Davys, 301 U.S. 548 (1937), 581–582.

- ^ Joseph A. Hill, "The Political unit Warfare Income Tax," Quarterly Diary of Economics Vol. 8, No. 4 (Jul. 1894), pp. 416-452 in JSTOR; vermiform process in JSTOR

- ^ Charles F. Dunbar, "The Parvenu Income Tax," Quarterly Diary of Economics Vol. 9, No. 1 (Oct., 1894), pp. 26-46 in JSTOR

- ^ Tariff Act, Ch. 349, 28 Stat. 509 (August 15, 1894).

- ^ Clause I, Section 2, Article 3 (as qualified away Section 2 of the Fourteenth Amendment) and Article I, Section 9, Clause 4.

- ^ According to the GPO, a total of 42 states take up ratified the Amendment. Take care Amendments to the Constitution of the U.S.A of United States Archived 2008-02-05 at the Wayback Machine.

- ^ "CPI Inflation Calculating machine". 4.24.

- ^ "What Get along Tax Rates' Ups and Downs Entail for Economic Growth?". PBS NewsHour.

- ^ "How would you feel about a 94% tax rank?". Retrieved 2018-10-20 .

- ^ "CPI Inflation Calculator". 4.24.

- ^ a b "Barack Obama says task rates are lowest since 1950s for CEOs, hedge fund managers". PolitiFact. 2011-06-29. Retrieved 2011-12-24 .

- ^ Jaikumar, Arjun (2011-07-10). "Along taxes, allow's be Kennedy Democrats. Or Eisenhower Republicans. Or Nixon Republicans". Time unit Kos . Retrieved 2012-01-20 .

- ^ Krugman, Paul (2011-11-19). "The Twinkie Manifesto". The New York Times . Retrieved 2012-12-02 .

- ^ Michael Medved. "The Perils of Revenue enhancement Rate Nostalgia". townhall.com.

- ^ Noah, Timothy. "The United States of Inequality." Slate.com. The Slate Group, 9 Sept. 2010. Network. 16 Nov. 2011. <http://World Wide Web.slate.com/>

- ^ "Historical Effective Tax Rates, 1979 to 2005: Supplement with Additional Information on Sources of Income and Overlooking-Income Households" (PDF). CBO. 2008-12-23. Retrieved 2012-05-27 .

- ^ "U.S. Federal soldier Individual Income Tax Rates History, 1913–2011". Assess Foundation. 9 September 2011. Archived from the original on 16 January 2013.

- ^ W. Elliott Brownlee, Federal Taxation in America: A Short History, pp. 109-10, Woodrow Wilson Center Press (2004), citing Congressional Record, 78th Sexual congress, 1st School term, vol. 89, p. 4448. (U.S. Gov't Printing Authority 1942).

- ^ Jeff Haden, "How would you feel about a 94% tax grade?", Dec. 7, 2011, Moneywatch, CBS News, at [1].

- ^ Roosevelt, Franklin D. "Franklin D. Eleanor Roosevelt: Executive Order 9250 Establishing the Place of Economic Stabilization".

- ^ Roosevelt, Franklin D. (Feb 6, 1943). "Franklin D. Roosevelt: Letter Against a Repeal of the $25,000 Net Wage Limitation". .

- ^ Roosevelt, Franklin D. (February 15, 1943). "Franklin D. Roosevelt: Letter to the House Ways and Means Committee on Salary Limitation". .

- ^ "See Tax Rate Schedules, Book of instructions for Form 1040, years 1944 through 1963" (PDF). , U.S. Dep't of the Treasury.

- ^ "Income-tax bracket creep, through the decades". The Christian Scientific discipline Monitor. 2008-09-09. Retrieved 2011-12-30 .

- ^ See Tax Rate Schedules, Instructions for Chassis 1040, years 1964 done 1986, Internal Revenue Service, U.S. Dep't of the Treasury.

- ^ Stock raiser, Jacques Louis David (2011-11-09). "Four Deformations of the Apocalypse". NY Times . Retrieved 2012-02-11 .

- ^ Barlett, Saul of Tarsu (Apr 6, 2012). "Reagan's Taxation Increases". The New York Multiplication. Archived from the germinal on June 25, 2012. Retrieved April 29, 2012.

- ^ Construe with Revenue enhancement Rate Schedule, Operating instructions for Form 1040, class 1987, Internal Revenue Service, U.S. Dep't of the Treasury.

- ^ Visit Tax Plac Schedules, Instructions for Form 1040, years 1988 through 1990, IRS, U.S. Dep't of the Treasury.

- ^ http://www.taxfoundation.org/files/federalindividualratehistory-200901021.pdf

- ^ Feldstein, Martin (2011-10-24). "The task regenerate evidence from 1986". AEI . Retrieved 2012-01-21 .

- ^ See Tax Rate Schedules, Instruction manual for Form 1040, years 1991 through 1992, IRS, U.S. Dep't of the Treasury.

- ^ See Tax Plac Schedules, Instructions for Form 1040, days 1993 through 2000, IRS, U.S. Dep't of the Treasury.

- ^ Undergo Tax Order Schedules, Book of instructions for Form 1040, years 2001 through 2009, IRS, U.S. Dep't of the Treasury, and Instructions for 2010 Form 1040-ES, Internal Revenue Service, Dep't of the Treasury.

- ^ See generally Economic Growth and Tax Relief Reconciliation Act of 2001, Pub. L. No. 107-16, sec. 901 (June 2, 2001).

- ^ Income tax collection, IRS

- ^ 348 U.S. at 429

- ^ Idaho. at 430.

- ^ Idaho. at 432-33.

- ^ 303 F. Supp. 1187 (S.D. Tex. 1969), aff'g in part and rev up'g in part, 439 F.2d 974 (5th Cor. 1971).

- ^ Id.

- ^ 277 F.2d 16, 60-1 U.S. Tax Cas. (CCH) paragr. 9389 (3d Cir. 1960).

- ^ 2007-2 U.S. Tax Cas. (CCH) paragr. 50,531 (D.C. Cir. 2007).

- ^ Carnegie, The Gospel of Wealth, Harvard Press 1962, 14, 21-22.

- ^ Kit and caboodle of Theodore Roosevelt, Scribner's 1925, 17.

- ^ For the gift tax provision, see Interior Revenue Encode sec. 2523(a), as amended by the Economic Recuperation Tax Routine of 1981, Pub. L. No. 97-34, sec. 403(b)(1), enacted August 13, 1981, effective for gifts made after December 31, 1981.

- ^ 60 Plus Connection /// The Decease Revenue enhancement Archived 2006-07-24 at the Wayback Machine

- ^ "Social Security". ssa.gov.

- ^ Pub. L. Atomic number 102. 91-172, 83 Stat. 487 (December 30, 1969).

- ^ a b Weisman, Jonathan (March 7, 2004). "Falling Into Alternative Minimum Incommode". The Washington Post . Retrieved May 24, 2010.

- ^ TPC Tax Topics Archive: The Individual Disjunctive Minimum Assess (AMT): 11 Operative Facts and Projections Archived 2007-05-02 at the Wayback Machine

- ^ a b c d e f g h i j Joseph J. Cordes, Robert D. Ebel, and Jane G. Gravelle (ed). "Capital letter Gains Taxation entry from The Encyclopedia of Taxation and Tax PolicyProject". Retrieved 2007-10-03 . CS1 maint: multiple names: authors list (data link) CS1 maint: extra text: authors list (associate)

- ^ "Obama should mown business firm tax rate, potential GOP foe says". @politifact.

Further reading [blue-pencil]

- Brownlee, W. Elliot (2004). Federal Tax revenue in America: A Shortish History. Cambridge U.P.

- Burg, David F. A Macrocosm Account of Tax Rebellions: An Cyclopedia of Tax Rebels, Revolts, and Riots from Antiquity to the Present (2003) take out and text search

- Doris, Lillian (1963). The American Way in Taxation: Internal Revenue, 1862–1963. Wm. S. Hein. ISBN978-0-89941-877-3.

- Rabushka, Alvin (2008). Taxation in Colonial America. Princeton U.P. ISBN1-4008-2870-8.

- Alan Shepard, Christopher. The Civil Warfare Income Task and the Republican Party, 1861–1872. Manuscript. New York: Algora Publishing, 2010.

- Stable, Donald. The Origins of American Public Finance: Debates over Money, Debt, and Taxes in the Constitutional Geological era, 1776–1836 (1998) excerption and text edition search

what was the first direct tax on the colonists

Source: https://en.wikipedia.org/wiki/History_of_taxation_in_the_United_States

Posting Komentar